Even in states that do not impose specific disclosure requirements, a seller has certain basic obligations to refrain from fraud or misrepresentations in negotiations with the buyer. Accurately completing a disclosure form protects a seller from liability for defects that were disclosed. Many but not all states impose specific disclosure requirements on sellers. At a real estate closing, the seller transfers ownership of the property to the buyer, who will sign their loan documents and provide the down payment to the seller.īefore committing to purchase a property, a buyer probably wants to know about any significant problems that may affect its value or their interest in it. Once contingencies have been resolved, and the other terms of the agreement have been met, the transaction can proceed to the closing. Common contingencies may include getting a loan or completing a home inspection. These are conditions that must be met before the transaction may be completed. Among other things, it provides the financial terms of the transaction, identifies the people and the property involved, sets any time requirements for completing the process, and outlines contingencies. The purchase and sale agreement forms the core of a real estate transaction. The main functional difference is that a deed of trust usually allows for a faster foreclosure process than does a mortgage if the borrower fails to keep up with payments. A mortgage involves only a borrower and a lender, while a deed of trust also involves a trustee, who holds title to the property for the benefit of the lender. Some states recognize only one of these instruments, while other states allow either of them or provide additional options. They generally will secure either a mortgage or a deed of trust. Most buyers cannot pay the full price of a home upfront and thus will need assistance from a lender. Many states use deeds that fall between these extremes as well. By contrast, a quitclaim deed provides no assurances, simply giving the buyer any interest that the seller may have in the property.

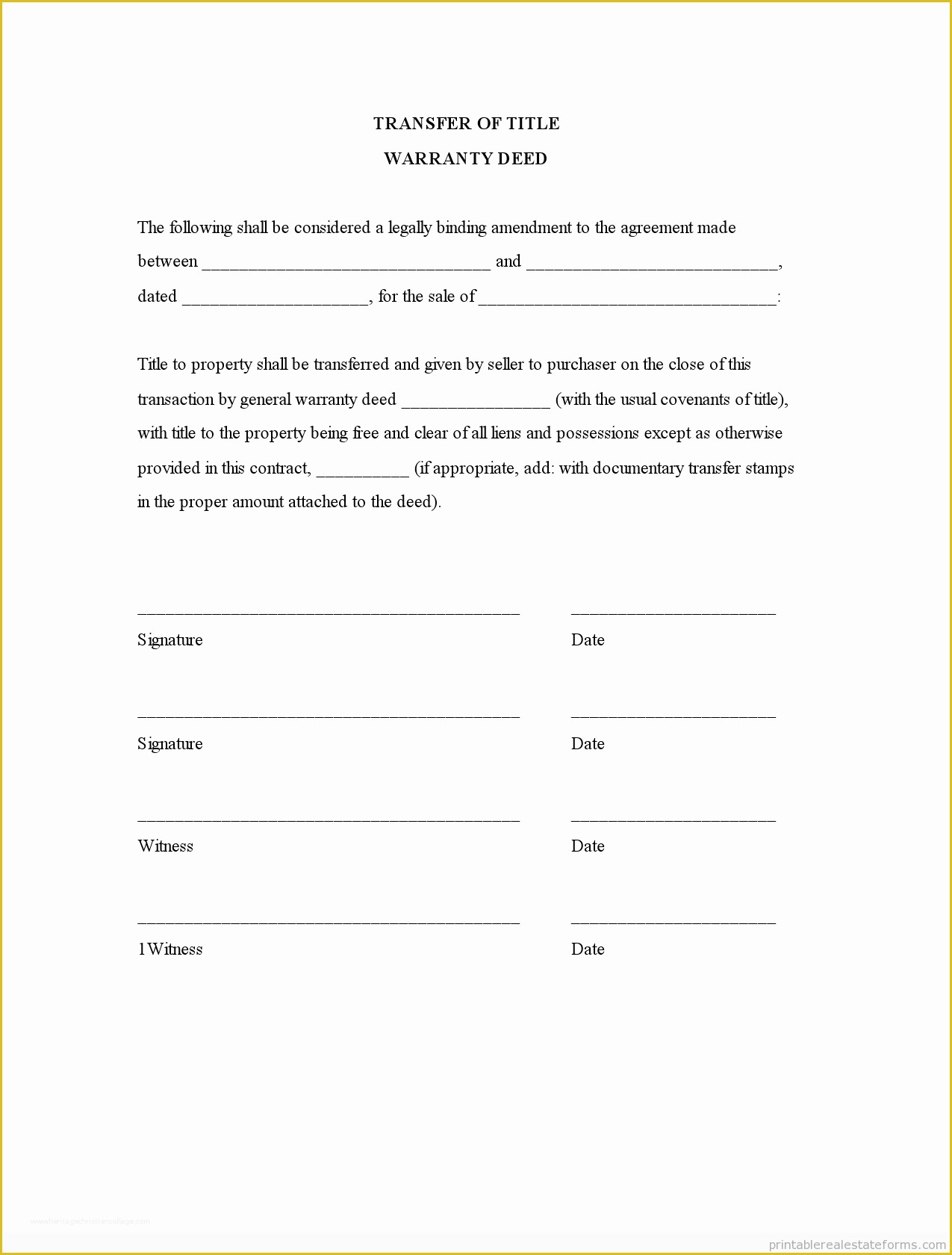

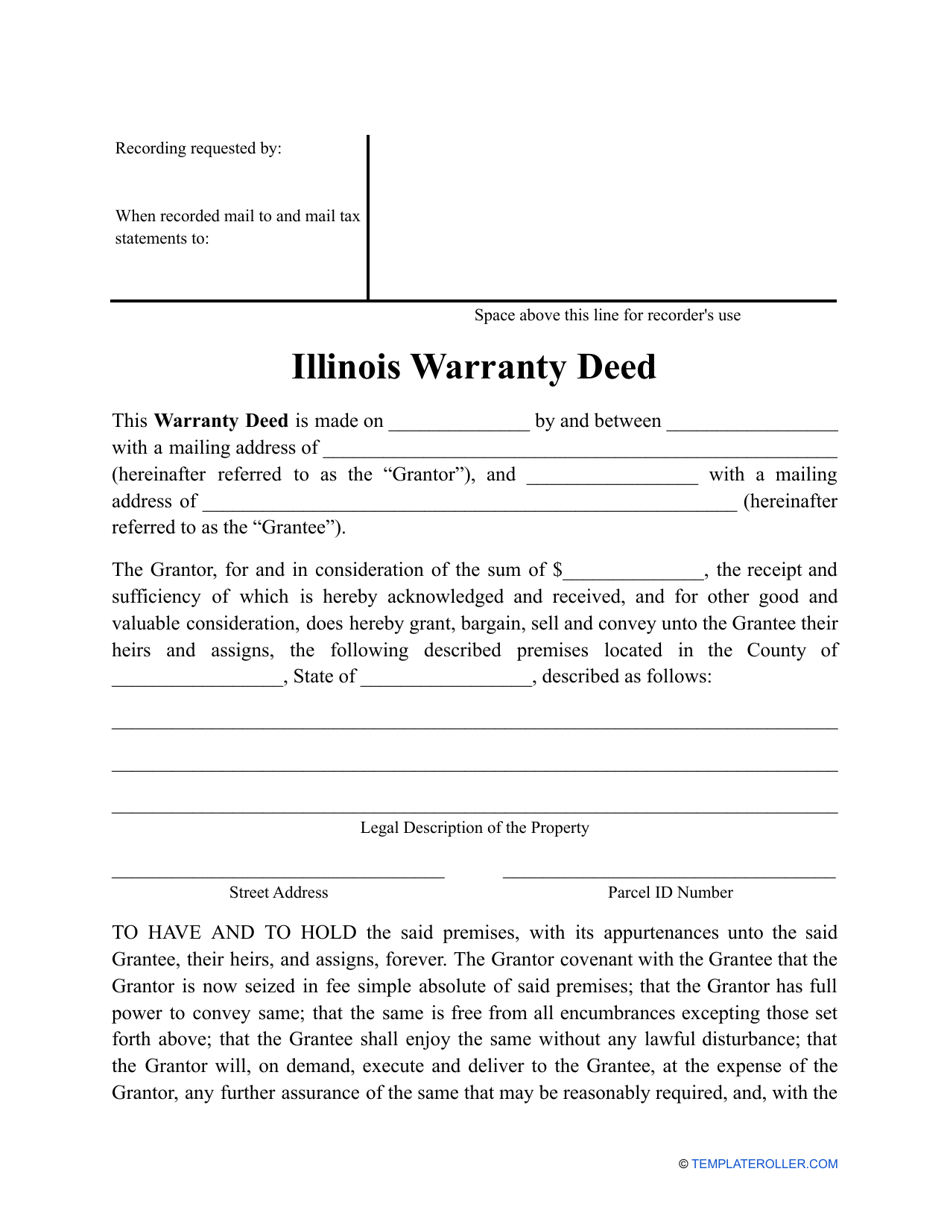

A general warranty deed assures the buyer that the seller owns and has a right to sell the property, and the property does not have liens, debts, or encumbrances associated with it. Among the main types of deeds, a general warranty deed provides the greatest protection to a buyer, while a quitclaim deed provides the least protection. The main instrument used to transfer ownership of property is known as a deed. Even if an attorney is not required, a buyer and a seller each may want to retain legal counsel to protect their interests. Some states require an attorney to assist with a real estate transaction. The process can be complex, involving a lengthy search for homes in a desired location, securing financing from a lender, and devising a real estate purchase and sale agreement.

For many people, purchasing a home is a significant investment on emotional and financial levels.

0 kommentar(er)

0 kommentar(er)